Investment University - 6th edition coming soon

Two months of hybrid learning for professional investing in global financial markets. From scratch, for everyone. Here you will take a step forward and learn how to invest professionally on international stock exchanges

The only initiative of its kind in Poland - you need to know it

Each year, more than a hundred people have the opportunity to take a whole semester of classes on how to invest professionally in international financial markets. Over the course of several months, we meet online to learn how to find the best companies in the world and then build them into a professional investment portfolio that beats the benchmark. All using state-of-the-art tools based on proprietary algorithms.

Investment University means

-

Two months of learning

Over 12 hours of offline material and over 20 hours of online meetings

-

We are based on the CFA

One interactive whiteboard, but dozens of presentations and hundreds of issues

-

Activities for everyone

All run from scratch. Regardless of level or capital

Classes are held once a year

What is on the agenda?

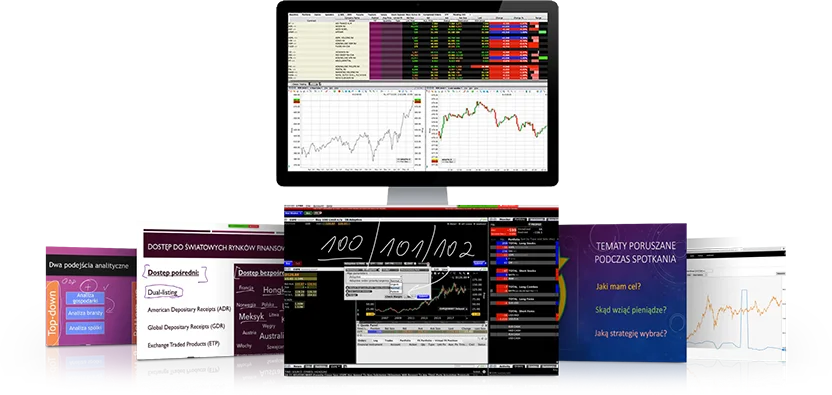

Key market principles

In this introductory class, you will learn how foreign financial markets really work and learn the rules governing global stock markets and the most important parameters of the economy.

- Investment platform operation and order routing

- Currency hedging and use of margins

- Why do some companies rise and others fall?

- Impact and assessment of the macroeconomic environment

- Free and paid information channels

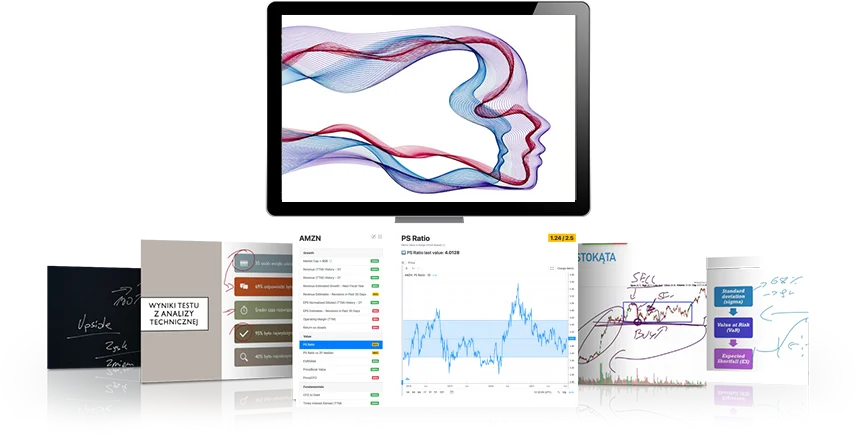

The mother of all foundations

In this section you will learn where to look and how to evaluate investment candidates. You will learn ways to distinguish expensive companies from cheap ones. You will find that reading financial statements is not difficult at all.

- Company valuation and calculation of a fair share price

- Determination of profitability and investment potential

- Overview and discussion of popular indicators

- Examination of the company’s financial stability and forecasts

- Use of foundation scanners

Portfolio optimisation and risk

How to build a professional investment portfolio? What proportions to use? How many companies to put in a portfolio? When to rebalance the entire portfolio? When to average out? When to cut losses? How to break down correlation.

- Modern Portfolio Theory vs. CAPM

- Indicators: Beta, Sharp, Sortino and CALMAR

- Risk and volatility management (VaR, ES)

- Hierarchical Risk Parity and Equally Risk methods

- Keeping an eye on proportions and a rebalancing system

Use of algorithms

During the University’s meetings, we will largely be working on the revolutionary latest SCRAB system for automating the entire investment process.

- Professional scanner filtering 37,000 companies

- Tools to visualise hundreds of data series

- Building an advanced scoring model

- Backtesting the strategy over several decades

- Automatic portfolio monitoring and alert system

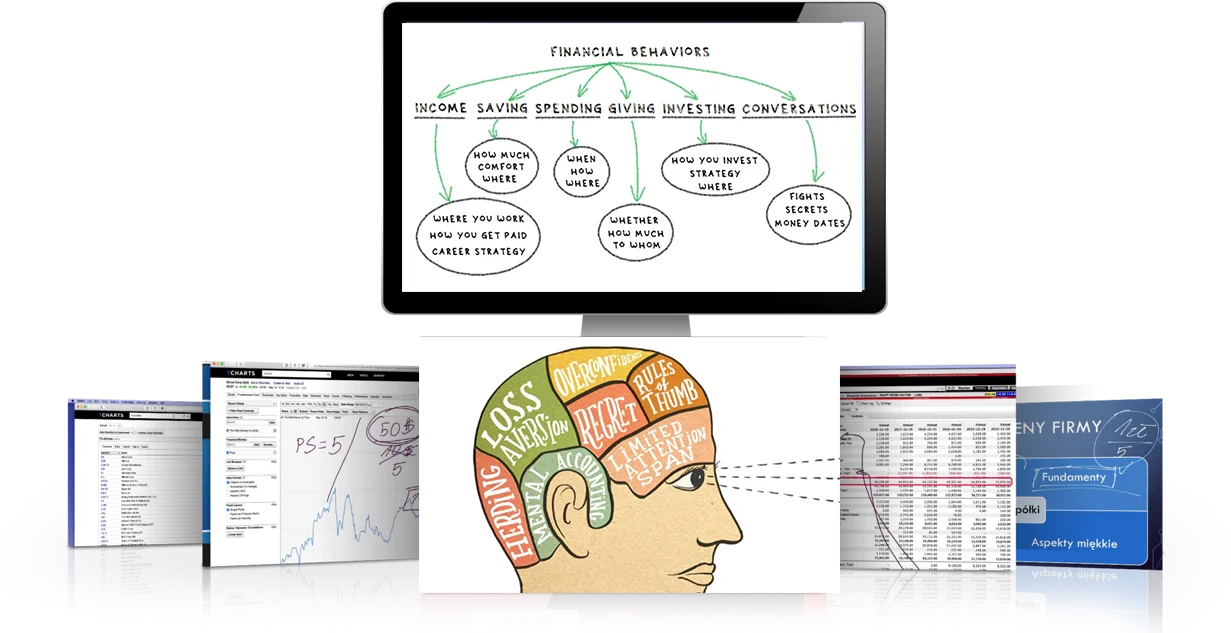

The dangerous mind of an investor

Don’t let your brain sabotage your stock market decisions. Understanding the mechanics of the market is essential, but only by mastering your mind will you get the greatest results.

- Why do we do things we don’t want to do?

- Major financial cognitive errors

- The problem with evaluating performance after the fact

- More information vs. less information

- How not to rely on hunches, but on data?

.